Either cash sale or credit, we need to reduce cash or account receivable accounts and reduce the revenues. Accounting for sales return is mainly concerned with revising revenue and cost of goods sold previously recorded. Account receivable or cash and cash equivalents should also affect whether it is the cash sale or credit sales. There are several reasons why it is essential to derive a correct cost of goods sold figure.

Related terms and concepts to cost of goods sold in accounting

COGS determines how profitable the product or service the company offers. While COGS and operating expenses are different, they are both important in measuring the success of a business. This is especially important if you are using a lot of raw materials in your production process. COGS and operating expenses are different sets of expenditures incurred by the business in running their day-to-day operations.

What Is Included in the Cost of Goods Sold (COGS)?

Understanding inventory turnover helps optimize inventory levels and identify slow-moving or obsolete inventory. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

Cost of goods sold journal entry

The balance sheet only captures a company’s financial health at the end of an accounting period. This means that the inventory value recorded under current assets is the ending inventory. Cost of goods sold (COGS) refers to the direct costs of producing the goods sold by a company. This amount includes the cost of the materials and labor directly used to create the good. It excludes indirect expenses, such as distribution costs and sales force costs. Assume that a company uses a contra expense account to record the amounts that employees paid toward the company’s health insurance costs.

- The company may be purchasing excessive or duplicate inventory because it’s lost track of certain items or it’s using existing inventory inefficiently.

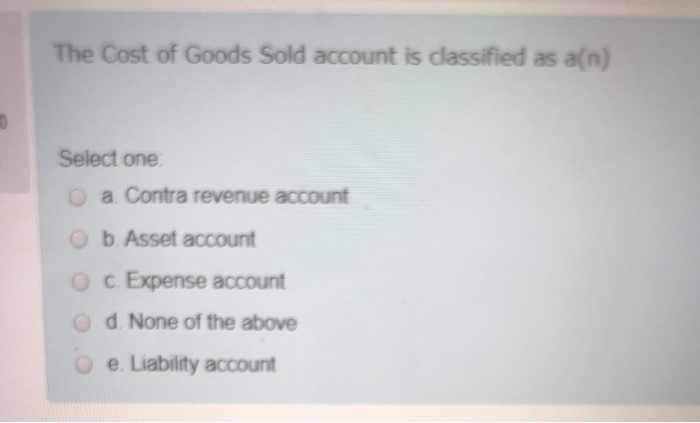

- Because COGS is a cost of doing business, it is recorded as a business expense on income statements.

- The balance is held as a current liability (credit) on the balance sheet of the business.

- Cost of goods sold is the direct cost of producing a good, which includes the cost of the materials and labor used to create the good.

Create a Free Account and Ask Any Financial Question

For this reason, contra accounts are primarily seen as having negative balances because they are used to reduce the balance of another account. These contras reduce the equity account and carry a debit balance. Contra equity reduces the total number of outstanding shares on the balance sheet. The key example of a contra equity account is Treasury stock, which represents the amount paid to buyback stock.

Sales Allowances

In this method, the cost of the latest products purchased is the first to be expensed as COGS. Examples of pure service companies include accounting firms, law offices, real estate appraisers, business consultants, and professional dancers, among others. Even though all of these industries have business expenses and is cost of goods sold a contra account normally spend money to provide their services, they do not list COGS. Instead, they have what is called “cost of services,” which does not count towards a COGS deduction. When accounting for assets, the difference between the asset’s account balance and the contra account balance is referred to as the book value.

Then in account 4211 they can see the portion of the cost that was paid by the employees. The company’s income statement will report the combination of the amounts in accounts 4210 and 4211 in order to show the company’s actual expense of $8,000 ($10,000 minus $2,000). Sales revenue is the income statement account, and it is recognized when the control is passed to customers.

One Main-account can have several Sub-accounts,each of which can have Sub-sub-accounts. In such a case, a Sub-account mightrepresent a group of similar, related products, where a Sub-Sub-account mightrepresent an individual product or service. Inventory turnover is a measure of how quickly a company sells its inventory and replaces it with new stock. It is calculated by dividing the cost of goods sold by the average inventory value.

Parts and raw materials are often tracked to particular sets (e.g., batches or production runs) of goods, then allocated to each item. Sales returns and allowance are the contra account to the sales revenues where the previously recognized sales need to be derecognized by recording into this account. They are recorded as different line items in the income statement, but both are subtracted from the revenue or total sales.